Real estate price development in Switzerland in 2025 and prospects for 2026

01.12.2025

The Swiss real estate market holds surprises: after a solid year 2025, the forecasts for 2026 reveal both real investment opportunities and more risky areas. Here are the main market developments to know in order to anticipate the coming year.

The variations depend on the type of municipality:

The most marked imbalances are found in the tourist regions of Graubünden, strongly impacted by the boom in secondary residences while the housing supply remains structurally limited. This combination creates lasting pressure on prices.

In French-speaking Switzerland, tensions have increased around Lake Geneva, where price growth clearly exceeds that of incomes. The region of Yverdon-les-Bains and the Pays d’Enhaut also show high imbalance levels. In Geneva, however, the risk remains moderate: the price progression has been more contained recently, which limits overheating for the moment.

In German-speaking Switzerland, several primary-residence markets now show worrying signals. The region of Einsiedeln has been in a tense situation for several years, but the analysis now also highlights strong imbalances in the city of Zurich and in the canton of Nidwalden, where prices have increased faster than local financial capacities.

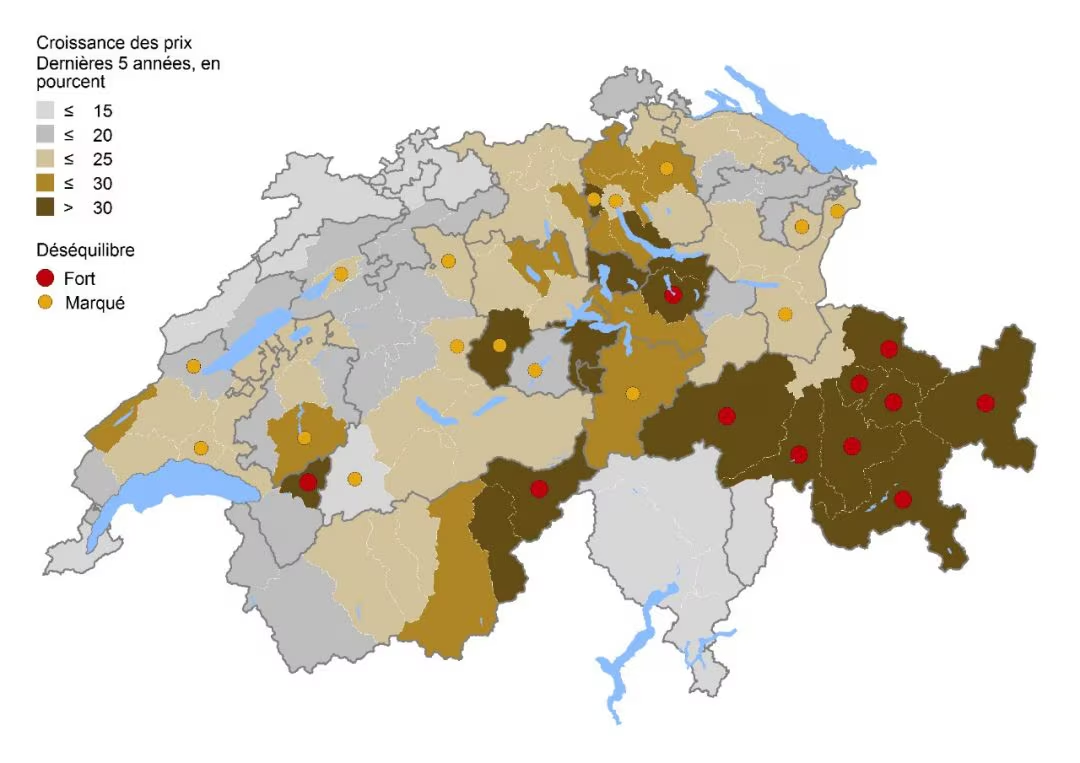

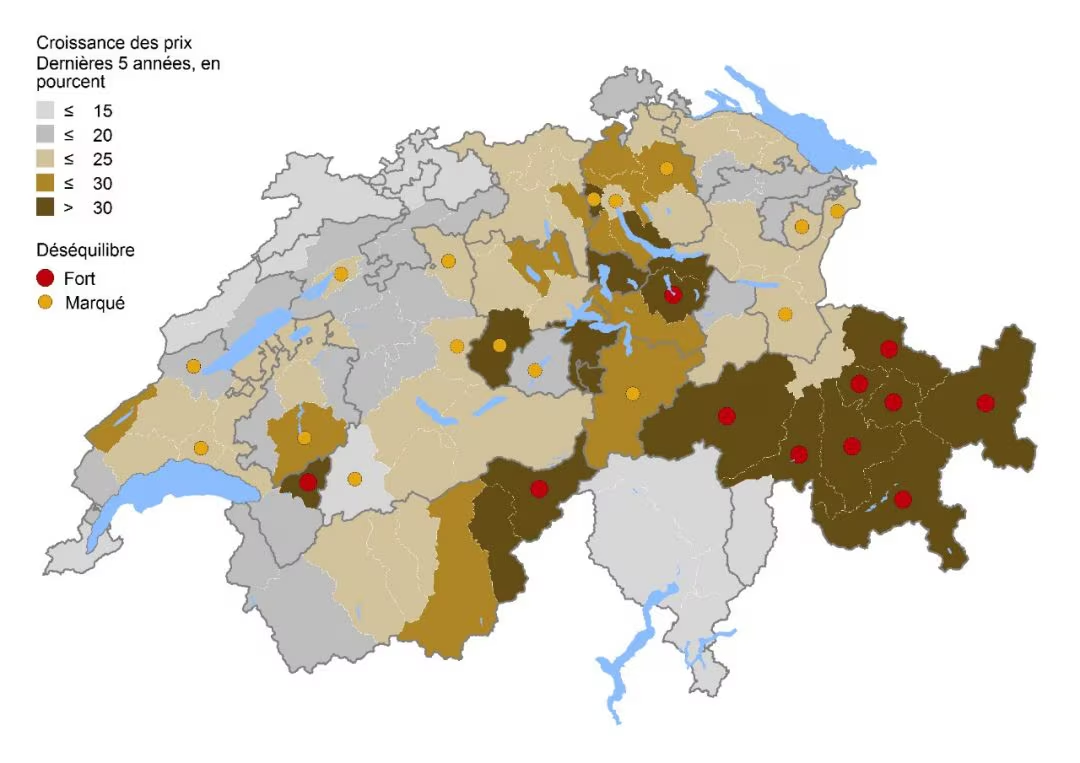

The map below summarizes the cantons showing the strongest performances but also the highest risk levels for 2026. These are profitable but potentially risky markets. Conversely, the other more stable regions and less exposed to imbalances offer safer investment opportunities better suited to a sustainable strategy.

The sub-index “price evolution” confirms this dynamic: it jumps to +89.0 points, compared to +32.0 in 2024, also reaching a record. Two years earlier, this indicator was still negative.

According to KPMG, this improvement reflects pressure on real-estate investment and expectations of rising rents, which strengthen the attractiveness of the residential market. For the first time, positive expectations concern all types of locations, even if the dynamics remain more pronounced in big cities (+117.6 points). They are also very high in medium-sized centers and agglomerations (+90.0 points) and now positive in peripheral regions (+16.3 points), whereas these values were still 40 to 60 points lower last year.

Conversely, analyses indicate a price evolution weaker than average in several areas, particularly around Lake Geneva, along the Jura Arc, and in the northwest of Switzerland, where markets seem to have reached a saturation level or a more moderate growth pace.

On the other hand, a second scenario envisions a purchase demand that remains solid. With an interest rate that remains low, financing conditions remain advantageous, which encourages many households to maintain their real-estate project despite the economic context.

However, several regions present overheating risks (Graubünden, Yverdon, Pays d’Enhaut, Zurich, Nidwalden), which encourages investors to prioritize more balanced markets and residential segments that still offer strong and sustainable growth potential.

swissinfo.ch - Article

ubs.com - Article

immoday.ch - Article

monimmeuble.com - Article

allnews.ch - Article

bfs.admin.ch - Article

2025 review of real estate prices in Switzerland

During the last quarter, the prices of owner-occupied housing increased by 0.8%. Over one year, the rise reaches 3.5%, the highest pace in three years, in a context where the consumer price index has remained practically stable.Detail by type of property and by municipality

In the 3rd quarter of 2025, prices continued their progression:- Single-family houses: +1.5%

- Owner-occupied apartments: +0.1%

The variations depend on the type of municipality:

- Marked increase in intermediate municipalities: houses +3.7%

- Decrease in large urban areas: houses –0.8%, apartments –0.9%

- Increase in small urban areas or outside urban areas: apartments +1.3%

Rental market

The rental market evolves more moderately:- Offer rents (new leases): +1.1% over one year

- Existing rents (current leases): +1.4%

UBS Swiss Real Estate Bubble Index in the 2nd quarter of 2025

The UBS Swiss Real Estate Bubble Index assesses the risk of real-estate overheating situations by measuring whether prices move too far away from economic fundamentals (income, rents, indebtedness). The index relies on several sub-indicators, notably the price/rent and price/income ratios, the real price evolution over three and ten years, the comparison of purchase and rental costs, as well as the ratios linked to mortgage indebtedness. Between the 2nd and 3rd quarter of 2025, the index rose from 0.20 to 0.29, indicating a slight increase in risk.Overheating forecasts: where are the risks highest?

The analysis of the 106 Swiss economic regions shows where prices have deviated the most from their fundamentals, notably through the price/income and price/rent ratios. When these gaps become significant, they indicate that the market enters an overheating phase, meaning that the price rise is no longer supported by local financial capacities nor by expected returns.The most marked imbalances are found in the tourist regions of Graubünden, strongly impacted by the boom in secondary residences while the housing supply remains structurally limited. This combination creates lasting pressure on prices.

In French-speaking Switzerland, tensions have increased around Lake Geneva, where price growth clearly exceeds that of incomes. The region of Yverdon-les-Bains and the Pays d’Enhaut also show high imbalance levels. In Geneva, however, the risk remains moderate: the price progression has been more contained recently, which limits overheating for the moment.

In German-speaking Switzerland, several primary-residence markets now show worrying signals. The region of Einsiedeln has been in a tense situation for several years, but the analysis now also highlights strong imbalances in the city of Zurich and in the canton of Nidwalden, where prices have increased faster than local financial capacities.

Where is it advised not to invest currently?

Given the overheating risks, the following areas present a risky investment profile in 2026:- The tourist regions of Graubünden (high prices, limited supply)

- Yverdon-les-Bains (price growth above fundamentals)

- The city of Zurich (high price level)

- The canton of Nidwalden (rapid rise disconnected from local incomes)

The map below summarizes the cantons showing the strongest performances but also the highest risk levels for 2026. These are profitable but potentially risky markets. Conversely, the other more stable regions and less exposed to imbalances offer safer investment opportunities better suited to a sustainable strategy.

In which segments do investors plan to allocate their capital?

According to surveys, if a fictitious amount of 100 million francs had to be invested over the next twelve months, nearly two-thirds would be directed toward the residential segment. For institutional investors, particularly pension funds and insurers, this share would even reach at least 75%.Market sentiment: optimism for 2026

The Swiss Real Estate Sentiment Index (Sresi®), which has measured the sector’s expectations regarding price and economic evolution over the next 12 months since 2012, reaches this year a historic level. After a low point of –77.4 points in 2023, it now stands at +69.5 points.The sub-index “price evolution” confirms this dynamic: it jumps to +89.0 points, compared to +32.0 in 2024, also reaching a record. Two years earlier, this indicator was still negative.

According to KPMG, this improvement reflects pressure on real-estate investment and expectations of rising rents, which strengthen the attractiveness of the residential market. For the first time, positive expectations concern all types of locations, even if the dynamics remain more pronounced in big cities (+117.6 points). They are also very high in medium-sized centers and agglomerations (+90.0 points) and now positive in peripheral regions (+16.3 points), whereas these values were still 40 to 60 points lower last year.

Where are price increases most likely in 2026?

Industry professionals anticipate the strongest progress in the following regions:- Zurich: +117.3 points

- Lucerne / Zug: +108.1 points

- Geneva: +84.4 points

- Lausanne: +83.1 points

Regional prospects for real estate prices

The best growth prospects, meaning price increases above the average, concentrate in regions where local demand exceeds supply, where price momentum remains solid, and where the relative level of residential prices still leaves potential for appreciation. According to these criteria, the regions offering the most favorable conditions are: Upper Valais, the Bernese Oberland, Chur, Lucerne and Schaffhausen.Conversely, analyses indicate a price evolution weaker than average in several areas, particularly around Lake Geneva, along the Jura Arc, and in the northwest of Switzerland, where markets seem to have reached a saturation level or a more moderate growth pace.

Real-estate demand: two possible scenarios in 2026

The evolution of demand in 2026 could follow two distinct trajectories. On the one hand, socio-economic uncertainty could lead some households to postpone their purchase project. In this case, demand would shift toward smaller and more affordable properties, or toward the rental market, where compact housing remains highly sought after.On the other hand, a second scenario envisions a purchase demand that remains solid. With an interest rate that remains low, financing conditions remain advantageous, which encourages many households to maintain their real-estate project despite the economic context.

Real estate 2026: a stable Swiss market

Despite an unstable international context, internal conditions continue to strongly support the Swiss real-estate market.- Low mortgage rates: they maintain high residential demand and strengthen the attractiveness of stable-return investments.

- Zero inflation: it preserves the real value of returns and limits the rise in operating costs.

- Positive labor market: even with a slight slowdown, employment growth guarantees a constant need for housing, which stabilizes rental risk.

- Insufficient construction: faced with sustained demand, the low construction volume reinforces scarcity, which maintains upward pressure on prices and rents, especially in urban centers.

Conclusion

In 2025, the prices of owner-occupied housing continued their rise (+3.5% over one year), while market indicators confirm very positive expectations for 2026, particularly in major centers such as Zurich, Geneva, Lausanne or Zug.However, several regions present overheating risks (Graubünden, Yverdon, Pays d’Enhaut, Zurich, Nidwalden), which encourages investors to prioritize more balanced markets and residential segments that still offer strong and sustainable growth potential.

Sources

ubs.com - Articleswissinfo.ch - Article

ubs.com - Article

immoday.ch - Article

monimmeuble.com - Article

allnews.ch - Article

bfs.admin.ch - Article